Staff reports | The College of Charleston’s Race and Social Justice Initiative at the Avery Research Center for African American History and Culture will rename its Student Leadership Award to honor James E. Campbell, a longtime civil rights activist, global educator and friend of the Avery Research Center.

According to a press release, the initiative’s Student Leadership Award is a commitment to promote student development through a $6,000 travel and research stipend divided among 10 student-leaders who recognize the importance of social justice activism. Inspired by the findings of the The State of Racial Disparities in Charleston County, South Carolina 2000–2015, a study conducted and published by initiative, the award funds students who are actively finding solutions for the pervasiveness of racial inequality and injustice within the Lowcountry, the South and the country at large.

Campbell, an African American educator and civil rights activist born in 1925, worked as a teacher in Baltimore, New York and Tanzania. He later became an administrator with the New York City public school system. Campbell also served as contributing editor for the journal Freedomways. Relocating to Charleston after retirement, he became a community activist and continued his involvement with educational initiatives. Throughout his life, Campbell has worked with organizations focused on socialism, Pan-Africanism, freedom struggles and equity in education. In dedicating the award in Campbell’s name, the initiative’sI leaders said they hoped his lifelong commitment to civil rights will inspire future agents of change.

Previously awarded to undergraduate and graduate students at the College of Charleston, the RSJI is expanding the award’s reach for 2019-20 by inviting applications from students from South Carolina’s six historically black colleges and universities (Claflin University in Orangeburg, South Carolina State University in Orangeburg, Benedict College in Columbia, Allen University in Columbia, Voorhees College in Denmark, and Morris College in Sumter.

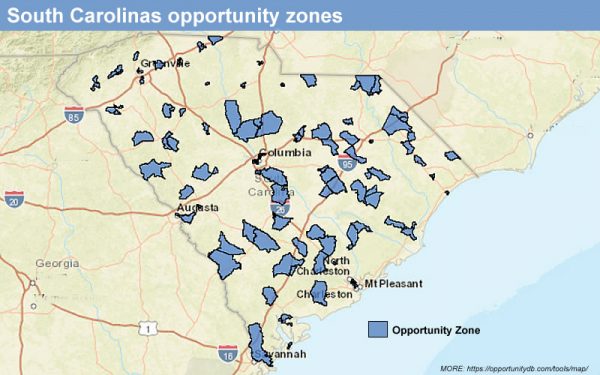

Pendarvis seeks to make federal opportunity zones work better

By Lindsay Street, republished from StatehouseReport.comt | A state Democratic lawmaker wants to “supercharge” a new federal tax break aimed at fueling private investment — and subsequently, jobs, housing and business — in blighted areas.

The federal Opportunity Zones tax break has received criticism from national publications and tax policy experts who say it benefits the wealthy and promotes gentrification.

But S.C. Rep. Marvin Pendarvis of North Charleston sees a bright side. That’s because the federal tax break needs a state component to make it successful, he said.

“If what I propose gets introduced and passed, it changes lives tremendously,” said Pendarvis, a Democrat. Half of his district is in an opportunity zone that he said is plagued with drugs, crime, homelessness and hopelessness. “We’re facing some real-life challenges in these zones … We need to make sure the investment has a return for the people as well.”

Pendarvis wants to add a state-level tax break for developers, but with a caveat: There needs to be tangible community benefit — such as jobs, affordable housing or green space — from qualifying projects. He said his bill, which will be prefiled prior to the 2020 session, will also track investments and promote community input to help create transparency and accountability.

The Opportunity Zones program is a tax break established in the Republican-backed 2017 federal tax overhaul. The program received bipartisan backing from U.S. Sens. Cory Booker of New Jersey, a Democrat, and Tim Scott of South Carolina, a Republican.

The Opportunity Zones program is a tax break established in the Republican-backed 2017 federal tax overhaul. The program received bipartisan backing from U.S. Sens. Cory Booker of New Jersey, a Democrat, and Tim Scott of South Carolina, a Republican.

The program allows developers to use capital gains — profits made from other investments — and re-invest that money into real estate and projects in specified zones, typically identified as low-income. The capital gains-fueled investment then will be untaxed unless the developer withdraws his or her investment before 10 years.

The idea is to spur new housing, businesses and jobs. One estimate says there is $2 trillion in capital gains funding that could be invested into the zones. The Tax Foundation estimated the program would cost $1.6 billion in revenue from 2018 to 2027. There are no estimates on what it could cost state governments, like South Carolina, that have coupled the state tax code with the legislation.

The relative newness of the Opportunity Zones program and the lack of centralized data collection on investments has made judging the success of the program problematic, according to tax policy experts.

A yearlong study of the Opportunity Zones program by The New York Times was released Aug. 30. The analysis relied mostly on anecdotal evidence, and highlighted a number of problems with the federally encouraged investments. The story reported “the Trump administration’s signature plan to lift (America’s poorest areas) — a multibillion-dollar tax break that is supposed to help low-income areas — has fueled a wave of developments financed by and built for the wealthiest Americans.” Read more.

“We may never know how effective this program is. We’re going to be relying on anecdotal information,” Center on Budget and Policy Priority senior fellow Michael Mazerov said. In May, federal lawmakers, including Scott, introduced legislation to require reporting on the investments.

- Read the full story on the Opportunity Zones program.

- Have a comment? Send to: editor@charlestoncurrents.com

We Can Do Better, South Carolina!

We Can Do Better, South Carolina!