FOCUS: Elections coming to the Lowcountry

COMMENTARY, Brack: S.C. not so polite to immigrants

IN THE SPOTLIGHT: Charleston RiverDogs

MONEY, Morris: Rules have changed on using 529 plans to fund education

WHAT WE LOVE: Tell us about something you love

FEEDBACK: Send us your thoughts

MYSTERY PHOTO: Impressive brick building

S.C. ENCYCLOPEDIA: Highway 301

CALENDAR, May 21+: Spoleto season gears up for 17 days on May 25

FOCUSFOCUS: Lots of elections coming to the Lowcountry

Staff reports | You can tell election time is nearing. Just witness all of the political advertising clutter between newsbreaks on the local television stations. This year, there are more competitive elections than in recent memory, likely because of the increasing inter-party sniping and overall partisanship, rants and social divides impacting the state and nation since the 2016 national election.

So we thought it would be helpful to provide you with an early guide to the elections on the ballot in federal, statewide, legislative and county offices in Charleston County so you can figure out who you might want to vote for and which primary you’ll make your picks.

So we thought it would be helpful to provide you with an early guide to the elections on the ballot in federal, statewide, legislative and county offices in Charleston County so you can figure out who you might want to vote for and which primary you’ll make your picks.

You can see a sample ballot based on where you live by checking your voter registration through SCVotes.org.

Following is a list of elections linked to candidate websites when we could find them:

DEMOCRATIC PRIMARY

Federal offices

DEM: U.S. House, District 1

DEM: Governor

Charleston County primary races

DEM: Probate Judge

DEM: Register of Deeds

Advisory questions, Democratic primary

1: Do you support passing a state law allowing doctors to prescribe medical marijuana to patients?

2: Do you support passing a state law requiring the governor of South Carolina to accept all federal revenues offered to support Medicaid and Medicaid expansion efforts in the state?

REPUBLICAN PRIMARY

Federal offices

GOP: U.S. House, District 1

![]()

Statewide offices

GOP: Governor

GOP: Secretary of State

- Nelson Faerber

- Mark Hammond

- Joshua Putnam

- Kerry Wood

GOP: Attorney General

Legislative races

(NOTE: There are 18 different ballot styles, each reflecting the single member districts in which voters live. You will only be able to vote for the candidates in these races that represent your home district.)

GOP: S.C. House of Representatives, District 15 (part of North Charleston area)

GOP: S.C. House of Representatives, District 94 (part of North Charleston area)

GOP: S.C. House of Representatives, District 110 (Peninsular Charleston, part of Mount Pleasant)

GOP: S.C. House of Representatives, District 112 (Isle of Palms, Sullivan’s Island, part of Mount Pleasant)

GOP: S.C. House of Representatives, District 116 (Hollywood, Ravenel area)

- Charles A. Glover

- Carroll O’Neal

GOP: S.C. House of Representatives, District 117 (Part of North Charleston)

Charleston County primary races

GOP: County Council, District Two (East Cooper area voters only)

GOP: County Council, District 8 (John’s Island, part of James Island)

GOP: County Council, District 9 (Most of James Island)

GOP: Register of Deeds

Advisory questions, Republican primary

- Do you believe that voters should have the option to choose to affiliate with a political party when they register to vote or change their voter registration in South Carolina?

- Do you believe that South Carolina’s tax code should be brought into conformity with the new Trump tax cuts in the federal tax code for maximum simplification and to lower the overall tax burden on South Carolina taxpayers and businesses?

- Have a comment? Send to: charlestoncurrents@gmail.com

BRACK: South Carolina not so polite to immigrants

By Andy Brack, editor and publisher | South Carolina has long been a home for immigrants — from the English, enslaved Africans and French Huguenots to Germans, Irish and, most recently, people from Latin America.

But these days, we shamefully ignore our rich immigrant soup, caught in the guttersnipe of national politics about “those people” who want to come to the United States, just like our forefathers moved here. And just like the grandfather of the forgetful current president, who has embarrassingly branded undocumented immigrants as “animals.”

But these days, we shamefully ignore our rich immigrant soup, caught in the guttersnipe of national politics about “those people” who want to come to the United States, just like our forefathers moved here. And just like the grandfather of the forgetful current president, who has embarrassingly branded undocumented immigrants as “animals.”

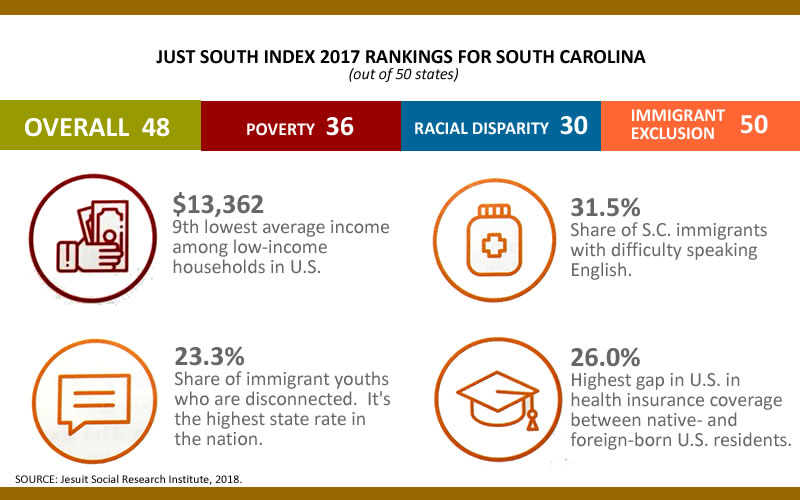

A new social justice report says South Carolina ranks dead last in how it excludes immigrants in thought, word and deed. Quite simply, we generally aren’t welcoming to immigrants, despite a reputation for being polite to visitors.

The Jesuit Social Research Institute at Loyola University in New Orleans recently released Just South Index 2017, a data-backed assessment of nine social justice indicators that look at wealth, opportunity and privilege. “Social injustice,” the report explains, “is any policy or system that detracts from the common good or undermines human dignity.” [NOTE: Quote corrected after original publication.]

The 42-page report calls attention to social justice deficits in three general areas: poverty, racial disparity and immigrant exclusion. Overall, South Carolina ranked third from the bottom in the Just South Index. But surprisingly, it wasn’t poverty (#36 of 50 states) or racial disparity (#30) that pushed us to the bottom. It was how we treat immigrants, which was based on three indicators:

- Rate of disconnected immigrant youths.Young adults (18 to 25) who aren’t in school, aren’t working or don’t have a college degree are considered disconnected. Those who are immigrants often fall into this category, susceptible to barriers for educational and other opportunities. Some 23.3 percent of immigrant youths in South Carolina are disconnected, the report says, the highest rate in the nation, which has a 14.6 percent rate, the report says.

- English language problems.South Carolina ranks 38th in the percentage of immigrants who have difficulty speaking English, but the state’s share of immigrants with language trouble (31.5 percent) is slightly lower than the national average (32.6 percent).

- Health insurance gaps.South Carolina also ranks last in the gap in the health insurance rate between foreign-born and native-born residents. The percentage gap between the two groups is 26 percent, compared to 13.8 percent nationally.

Bottom line: We fail to offer good opportunities to immigrant young adults, including making health care affordable, and we can do better in helping them learn English.

Sue Berkowitz, executive director of the S.C. Appleseed Legal Justice Center in Columbia, isn’t surprised by the Catholic university’s report, in part because of how institutions exclude immigrants.

“There had been — and still is — ongoing legislative/administrative actions that prove our state’s political leaders are targeting immigrants,” she told us, noting passage of anti-immigration laws and the GOP’s current obsession with sanctuary cities.

“Our state does not allow a whole category of documented individuals to get professional and technical licenses or get instate tuition,” she said. “Young immigrants, DACA beneficiaries or ‘dreamers’ who lived their entire life here [who were] brought to this country when children, are not allowed to get professional licenses or in-state tuition. Our own attorney general is suing the current administration to strip them of their documentation. All of this is a prime example of social exclusion.”

Our state can do more to include, not exclude. As outlined in the Just South report, states can reduce barriers to post-secondary education, bolster efforts for English as a Second Language programs, improve family literacy programs, encourage access of disconnected youths to job training programs and expand mentoring programs.

South Carolina, like most other Southern states, also doesn’t allow legally-residing immigrant children and pregnant mothers to use public health insurance without a five-year waiting period. State government and businesses should take steps to close the health insurance gap faced by immigrants.

We can do better. Let’s be more than a state that says “Lord, have mercy” or “Bless their hearts” to new immigrants to South Carolina. Let’s stop excluding people already here who might sound or look different. Let’s embrace their talents so they become productive residents who contribute to our culture and economy.

- Have a comment? Send to: charlestoncurrents@gmail.com

SPOTLIGHT: Charleston RiverDogs

The public spiritedness of our underwriters allows us to bring Charleston Currents to you at no cost. This issue’s featured underwriter is the Charleston RiverDogs, whose ballplayers had a great regular season.

The public spiritedness of our underwriters allows us to bring Charleston Currents to you at no cost. This issue’s featured underwriter is the Charleston RiverDogs, whose ballplayers had a great regular season.

The club celebrates its 25th season in 2018 (that’s 175 years in “Dog” years!! Last year, the team had 77 wins and made its second consecutive postseason appearance in the playoffs. While the season is now over, it’s not long before the 2018 starts.

The Lowcountry’s leader in sports entertainment, Charleston RiverDogs baseball is an attractive, affordable medium for your group or business. The RiverDogs develop the next major league stars for the 27-time World Champion New York Yankees at one of the finest ballparks in Minor League Baseball — Joseph P. Riley, Jr. Park.

Three short words sum up the everyday approach taken by the Charleston RiverDogs front office. The brainchild of club President Emeritus Mike Veeck, the nine-letter phrase “Fun Is Good” is meant to be a guideline and daily reminder of how employees should approach their jobs and in turn capture the imagination of the fans to turn them into repeat customers.

- Visit the ‘Dogs online at: RiverDogs.com

MORRIS: Rules have changed on using 529 plans to fund education

By Kyra Morris, contributing editor | No longer limited to college funding, 529 plans can now be applied for private elementary and secondary education. While this addition sounds like a good idea, it does introduce some new complexities. This new feature using 529 plans to fund secondary and elementary education requires a fresh lens to be fully appreciated. We’ll take a look at the new developments of this plan, the state’s position and what this could mean for your family.

Review: What is a 529 Plan?

A 529 Plan is a tax-advantaged savings plan to be used by anyone, regardless of income, to fund qualified higher education expenses like tuition, books, room and board. Although contributions are not tax deductible for federal income tax, 30 states provide tax deductions. The main advantage to the 529 plan is growth of the funds within the plan are not taxable to either federal or state, nor are the gains within the distributions taxable as long as the funds are used for qualified educational expenses.

A 529 Plan is a tax-advantaged savings plan to be used by anyone, regardless of income, to fund qualified higher education expenses like tuition, books, room and board. Although contributions are not tax deductible for federal income tax, 30 states provide tax deductions. The main advantage to the 529 plan is growth of the funds within the plan are not taxable to either federal or state, nor are the gains within the distributions taxable as long as the funds are used for qualified educational expenses.

What’s new: Tax reform and updates

While the precepts of 529 plans stay the same, the update from the new tax reform passed in December is that families can now use 529 plans to pay tuition for private secondary and elementary schools. A provision in the tax bill allows families to make tax-free withdrawals of up to $10,000 per year, per child, to provide for children attending private schools, kindergarten through 12th grades. This creates a new perspective when considering these vehicles.

The state’s perspective

529 plans are administered by individual states. Each state has different laws governing the use of the plans for their residents. Therefore, each state has to make the decision to accept the new federal provision.

The use of 529 plans for elementary and secondary schools is an incentive for private education funding, thus the state needs to consider if an expanded use of private education would change the quality of public education. For example, would a reduced head count in public schools subsequently lead to reduced federal or state funding? For those states providing tax incentives to use the plans, could the increased opportunity to provide funding for K-12 private or religious schools have an impact on the state’s tax base?

South Carolina currently offers a tax deduction for every dollar contributed to its 529 plan. These laws may change in the future for South Carolina, but right now South Carolina chose to adopt the new use of 529 plans. $10,000 withdrawals per year per child can be used for tuition expenses connected with enrollment in private or religious K-12 schools.

Parents’ perspective

While this addition may be seen as a benefit to providing private primary education, parents need to be careful when they consider this option. The ability to use 529 plans for education expenses prior to college changes the time horizon for the use of the funds. For a newborn child, instead of a long-term horizon of 18 years of investments may only be for five or six years. The longer time frame provides for better overall growth and allows for market fluctuations. The shorter time frame may limit the growth without undue market risk. This is important to note as the growth of the investments is what provides the foundation for the tax benefits of the 529 plan.

Originally 529 plans were intended to help provide funds for post-secondary education. With this new addition to the plan, parents need to be careful not to dip into the till too much for K-12 education as this will undermine their own attempts at college funding. Ultimately, using these funds too early misses out on the benefits of the accumulation of the tax-free growth.

How 529 plans will affect financial aid is another topic to discuss. Elementary and secondary schools will now have to consider the funds available in 529 plans as a potential funding source. Even if the intent was to keep these funds separate and only for college, the secondary or elementary schools may require the use of these funds before any financial aid is provided. The investments in 529 plans were not a big part of the review prior to the new tax reform.

Overfunding 529 plans is still an issue. If a plan is overfunded and the child does not need the funds for education, then there are a couple of options:

- The investments may be withdrawn. Taxes will be due on the gains and a 10% penalty on the gains is also incurred.

- Pass the funds to another child or relative. This can be done with no tax consequence. One potential benefit for the use of 529 plans for secondary schools is it may provide more opportunities for enhanced education funding, thus using up over funded plans.

Parents or grandparents contributing for young children still benefit the most from 529 plans. They have the time to allow the investments to work for them, and to strategize how to best use the plan. The new tax laws do provide more opportunities. However these new opportunities need to be considered wisely. We have the benefit of the old tried and true frames for the 529 plans, and now we have added a new lens. What can we see?

Kyra Hollowell Morris, a Certified Financial Planner, is CEO of Morris Financial Concepts, Inc., in Mount Pleasant. A national leader in the financial planning profession, she has been named several times by leading magazines as one of the country’s top financial planners.

- Have a comment? Send to: charlestoncurrents@gmail.com

WHAT WE LOVE: Tell us what you l0ve about the Lowcountry

![]() Tell us what you love. Send a short comment – 50 words to 100 words – that describes something you really enjoy about the Lowcountry. It can be big or small. It can be a place, a thing or something you see. It might the bakery where you get a morning croissant or a business or government entity doing a good job. We’ll highlight your entry in a coming issue of Charleston Currents. We look forward to hearing from you.

Tell us what you love. Send a short comment – 50 words to 100 words – that describes something you really enjoy about the Lowcountry. It can be big or small. It can be a place, a thing or something you see. It might the bakery where you get a morning croissant or a business or government entity doing a good job. We’ll highlight your entry in a coming issue of Charleston Currents. We look forward to hearing from you.

FEEDBACK: Send us your thoughts

We love hearing from readers. Comments are limited to 250 words or less. Please include your name and contact information. Send your letters to: charlestoncurrents@gmail.com | Our feedback policy.

MYSTERYMYSTERY PHOTO: Impressive brick building

You’ll be well out of the Lowcountry to find this impressive South Carolina building. So where is it? Send your guess to charlestoncurrents@gmail.com with “Mystery Photo” in the subject line. Please make sure to include your name and contact information.

Last issue’s mystery

The May 14 Mystery Photo literally was a mystery inside a mystery. Unfortunately because of email problems, we can’t share the names of those who correctly guessed it. (Sorry, we’re working on the issue.)

The May 14 Mystery Photo literally was a mystery inside a mystery. Unfortunately because of email problems, we can’t share the names of those who correctly guessed it. (Sorry, we’re working on the issue.)

But we can tell you the answer: It’s a booth for Mystery Beer ($2) at Joe Riley Stadium where the Charleston RiverDogs are currently in the midst of another fun-filled season. (Buying the mystery beer is fun too — you never know what you’ll get.)

- Send us a mystery: If you have a photo that you believe will stump readers, send it along (but make sure to tell us what it is because it may stump us too!) Send it along to charlestoncurrents@gmail.com.

HISTORY: Highway 301

S.C. Encyclopedia | Construction of this major U.S. highway in South Carolina began in 1932 during the Great Depression, when the federal government began taking over the maintenance and construction of many state roads. The route began at Baltimore, Maryland, and ended at Sarasota, Florida, crossing through many towns in eastern South Carolina, including Dillon, Latta, Florence, Manning, Olanta, Summerton, Bamberg and Allendale. From the North Carolina border to the Savannah River, Highway 301 covers a distance of approximately 180 miles.

The highway’s many nicknames are an indication that it was popular among tourists throughout the second quarter of the twentieth century. These names included: “Tobacco Trail,” “Highway of Southern Hospitality,” “Tourist Highway,” “Shortest Route from Maine to Florida,” and “The Washington-Florida Short Route.” This road was popular among tourists because it avoided some of the larger cities, had no toll bridges or ferries, and was paved its entire length.

During the 1950s this highway was a major U.S. north-south route, well known to travelers in the eastern United States. Even the popular television show I Love Lucy, featured an episode where Lucille Ball traveled in an automobile with a woman who always traveled Highway 301 to Florida. This highway created a demand for restaurants and motels in South Carolina. Some popular motels included the Lewis Motel in Olanta, the Santee Motor Company in Manning, the Holiday in Florence, and the Cotton Patch Motel in Bamberg.

The building of Interstate 95 in the late 1950s and 1960s, which ran almost parallel to U.S. 301, caused the tourist traffic to decline on the older highway. Businesses on U.S. 301, particularly the motel operators, had difficulty in maintaining their customer base. Several rebuilt near the interstate, while others operated at a much slower pace.

— Excerpted from an entry by Lloyd Johnson. To read more about this or 2,000 other entries about South Carolina, check out The South Carolina Encyclopedia, published in 2006 by USC Press. (Information used by permission.)

ON THE CALENDARCALENDAR, May 21+: Spoleto season gears up for 17 days on May 25

Staff reports | It’s that time of year again – day after day of great arts thanks to Spoleto Festival USA and its companion Piccolo Spoleto.

Spoleto Festival USA

Spoleto Festival USA offers dynamic opera, theater, dance, music, jazz and other shows for 17 days, starting May 25 and ending June 10. Season highlights include:

- Operas, such as Pia de’ Tolomei, Tree of Codes and Il matrimonio segreto;

- Theater, such as The Strange Undoing of Prudencia Hart, The Pied Piper and The Flying Lovers of Vitebsk;

- Dance, including the Miami City Ballet and Dorrance Dance;

- Bank of America Chamber Music, and several classical shows; and

- Wells Fargo Jazz, which includes the Fred Hersch Trio, Jon Batiste and Jazzmeia Horn.

Piccolo Spoleto

Among the popular Piccolo Spoleto offerings are:

- Lots of children’s programs at area libraries;

- Family Day at Marion Square, 10 a.m., May 26 (free);

- Midnight Pajama Parade with Seed & Feed Marching Abominable band, 11 p.m., May 26, U.S. Custom House, Charleston;

- Memorial Day Concert, 3 p.m., May 28, Marion Square;

- Piccolo Spoleto Festival Finale, Hampton Park, 5 p.m., June 10;

- Dozens of music programs, including Celtic, baroque, organ, jazz and more, including concerts and cruises.

- Theater and dance programs at the Footlight Players, Pure Theater, Threshold Rep, as well as the Piccolo Fringe at Theater 99.

Also on the calendar:

(NEW) Job fair: 10 a.m. to 3 p.m., May 23, Johnson Hagood Stadium, 69 Hagood St., Charleston. The Greater Charleston Area Restaurant Association and Charleston Area Hospitality Association offer a job fair with more than 50 employers from various industries. Free. More: Contact Stanley Cox.

(NEW) Barn jam: 6 p.m. to 9 p.m., May 23, Awendaw Green, Sewee Outpost, 4853 N. Highway 17, Awendaw. All ages are welcome for music by several bands. $5 donation requested. More.

Cybersecurity Summit: 8:30 a.m. to 4 p.m., May 24, Francis Marion Hotel, Charleston. The S.C. Chamber of Commerce, U.S. Chamber of Commerce and S.C. Cyber will host this second annual event with lots of security experts, including ex-CIA chief Michael Hayden. Registration begins at 8:30 a.m. for the day-long event. See the agenda. Cost: $75.

Moonlight Mixer: 7 p.m. to 11 p.m., May 25, Folly Beach Pier. Charleston County Parks resumes its popular event on select Friday nights to give folks the chance to dancer in the ocean breeze. Admission is $8 in advance or $10 at the gate. Other scheduled Moonlight Mixers are June 15, July 6, Aug. 17 and Sept. 14. More.

Flags on display: Starting June 1, The Charleston Museum, 360 Meeting St., Charleston. “Unfurled: Flags from the Collection of the Charleston Museum” will feature rarely shown flags from the early 19th century to the late 20th century with a variety of functions. More.

Music Under the Oaks: 11 a.m. on June 2, July 7 and Aug. 4, Charles Pinckney National Historic Site, 1254 Long Point Road, Mount Pleasant. On June 2, NIA Productions will feature African drumming and dance; On July 4, the show will feature singer Ann Caldwell while the Plantation Singers will perform Aug. 4. Bring sunscreen and insect repellant.

Early morning bird walks at Caw Caw: 8:30 a.m. every Wednesday and Saturday, Caw Caw Interpretive Center, Ravenel. You can learn about habitats and birds, butterflies and other organisms in this two-hour session. Registration not required, but participants are to be 15 and up. $10 per person or free to Gold Pass holders. More: http://www.CharlestonCountyParks.com.

AREA FARMERS MARKETS

SATURDAYS: The Charleston Farmers Market, is back in action from 8 a.m. to 2 p.m. every Saturday through Nov. 24 at Marion Square. A holiday market will be open Dec. 1, 2, 8. 9, 15 and 16.

SATURDAYS: Johns Island Farmers Market operates each Saturday from 9:30 a.m. to 1:30 p.m. year-round with more than 50 local farmers and vendors, food trucks, music and more. The market is located on the campus of Charleston Collegiate School, 2024 Academy Road, Johns Island.

SATURDAYS: The Town Market on James Island are again open. Open 9 a.m. to 1 p.m. every Saturday at the James Island Youth Soccer Club, 871 Fort Johnson Road, James Island.

TUESDAYS: The Town of Mount Pleasant’s Farmers Market is every Tuesday from 3:30 p.m. to 7 p.m. in the market pavilion at Moultrie Middle School, 645 Coleman Blvd, in Mount Pleasant.

WEDNESDAYS. The West Ashley Farmers Market, 55 Sycamore Ave., is open every Wednesday from 3 p.m. to 7 p.m. in Ackerman Park. More.

- If you have an event to list on our calendar, please send it to charlestoncurrents@gmail.com for consideration. The calendar is updated weekly on Mondays.

OUR UNDERWRITERS

Charleston Currents is an underwriter-supported weekly online journal of good news about the Charleston area and Lowcountry of South Carolina.

- Meet our underwriters

- To learn more about how your organization or business can benefit, click here to contact us. Or give us a holler on the phone at: 843.670.3996.

OUR TEAM

Charleston Currents offers insightful community comment and good news on events each week. It cuts through the information clutter to offer the best of what’s happening locally.

- Mailing address: O. Box. 22261 | Charleston, SC 29413

- Phone: 670.3996

Charleston Currents is provided to you weekly by:

- Editor and publisher: Andy Brack, 843.670.3996

- Contributing photographer: Michael Kaynard

- Contributing editor, careers: Ben Fanning

- Contributing editor, common good, Fred Palm

- Contributing editor, money: Kyra Morris

- Contributing editor, Palmetto Poem: Marjory Wentworth

SUBSCRIBE FOR FREE

Subscriptions to Charleston Currents are free.

- Click here to subscribe.

- We don’t want to lose you as a reader of Charleston Currents, go to the bottom of any of your weekly newsletters and click the “unsubscribe” function. If that doesn’t work, please send us an email with the word “unsubscribe” in the subject line.

© 2008-2018, Statehouse Report, LLC. All rights reserved. Charleston Currents is published every Monday by Statehouse Report LLC, PO Box 22261, Charleston, SC 29413.

We Can Do Better, South Carolina!

We Can Do Better, South Carolina!