By Kyra Morris, contributing editor | What is going on in the markets?

- The third quarter of 2018 ended as the best quarter on the S&P 500 since 2013 – around a 7.2 percent increase.

- From Sept. 30 through Oct. 26, the S&P lost around 8.6 percent, the worst beginning of a quarter since 2008.

Is this the October effect, or is there something substantial going on? What are the realities?

It’s difficult to come up with convincing fundamental explanations for this poor performance. As expected, the Feds did increase interest rates at the end of September. Investors can also purchase U.S. Treasuries yielding 3 percent. This increase in yields are driven primarily by rising real yields that tend to reflect rising growth expectations. Economic growth should more likely be a positive, rather than a negative factor for market sentiment.

Earnings are good overall, and valuations have come down because earnings have outpaced stock prices. Trade tariffs have had an impact on some sectors, but their impact on the overall economic growth and inflation is modest at best. Fiscal stimulus should still provide support for businesses. The job market is tight with more jobs available than workers to fill them. Inflation remains in check and is not yet an issue. New orders and production for manufacturing has been mixed but overall holding a steady, moderate pace. With so many U.S. averages breaking out with new all-time highs, the sign of an unhealthy market does not seem warranted.

At least until recently within the U.S. equity markets, investors were not all that worried about the fundamentals.

Could this latest weakness be simply another temporary panic attack? This is normal. The markets get nervous, and historically the S&P experiences a 5 percent decline about every two months on average. Have the markets forgotten how to deal with volatility? In 2017 there was not one 5 percent decline, and in 2018 the time lag between panic attacks was longer than usual. The last stock market setback was February this year.

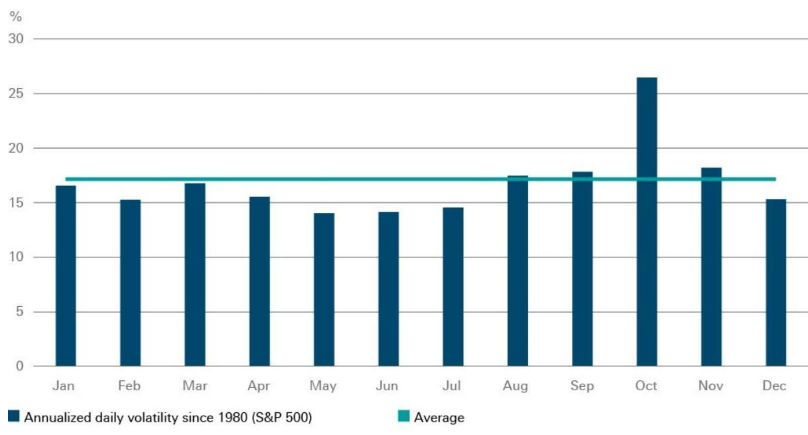

Seasonality statistics tell us that October should actually be a good month for stocks. But there’s another way of looking at seasonality. The chart below from Bloomberg Finance L.P. indicates that October is the most susceptible month to panic attacks. It is also, typically accompanied by unusually high levels of stock-market volatility. The data taken from 1980 through Oct. 18, 2018 shows that the average realized volatility tended to be fairly balanced for all calendar months. Only October stands out as the big exception.

October with the Great Depression, October with the crash in 1987, and October in 2008 all represent the market jitters that manifests itself in October. There is still the question: Why October? Unfortunately, there are not really any strong theoretical reasons to explain it. The study of calendar effects for a cause does not yield any answer except for a self-fulfilling phenomenon.

What’s next?

We believe there are some major macroeconomic factors that will be influential on investors over the next six to 12 months: trade policy, interest rates and Federal Reserve (Fed) policy, earnings growth, global economic growth, and the U.S. dollar.

Trade policy: Robert Bush, an economic strategist with DWS, said, “…tariffs in general can be thought of as throwing sand in the cogs of the usually well-oiled global trade machine.” Protectionism can damage the efficiencies of specialization and comparative advantage and erode economic gains overall.

Federal Reserve policy: The Federal Reserve policy is close to neutral. This may change in 2019 and 2020 as the economy is monitored rates may rise beyond the neutral level hopefully to keep overall economic alignment.

GDP growth: Gross Domestic Product growth is expected to remain moderately strong for the next six to 12 months, although somewhat slower reflecting the tight job market and the fading impact of fiscal stimulus.

The dollar: The value of the U.S. dollar is high currently. With some of the global uncertainties there is a flight to safety into U.S. Treasuries and the dollar.

From all I’ve read and studied to get a feel for what’s happening this October, I am not sensing that we are about to go over a cliff. Total doom and gloom are not apparent. There are issues to watch, and the economy will slow. Economic cycles will continue. I recommend positioning your portfolios to be able to ride through them. Do not try to time the markets. With all the underlying theories and causes identified, the realities are that the markets will continue to go up and down with a general upward slope over time.

Kyra H. Morris, a Certified Financial Planner, is CEO of Morris Financial Concepts, Inc., in Mount Pleasant. A national leader in the financial planning profession, she has been named several times by leading magazines as one of the country’s top financial planners.

- Have a comment? Send to: editor@charlestoncurrents.com

We Can Do Better, South Carolina!

We Can Do Better, South Carolina!