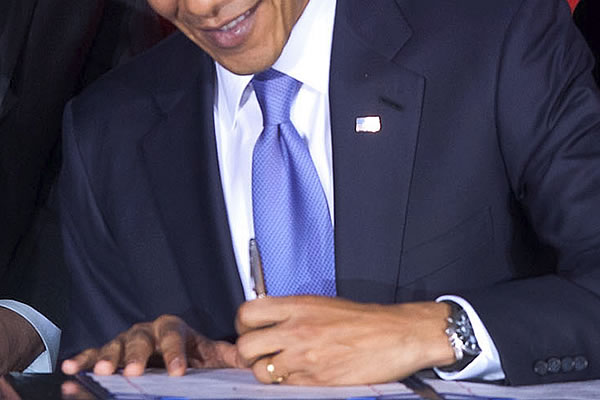

At the end of 2014, President Obama signed the Achieving a Better Life Experience Act (hereinafter “ABLE Act” or “Act”). The law creates a new tool for a person with a disability to save money without losing needs-based public benefits such as SSI or Medicaid. An ABLE account provides the special needs community with another option, in addition to special needs trusts, to consider when creating a plan for persons with a disability.

Who is an eligible beneficiary of an ABLE account? An ABLE account can be created on behalf of a special needs person of any age, as long as that person can establish that they were legally disabled prior to the age of 26.

Who is an eligible beneficiary of an ABLE account? An ABLE account can be created on behalf of a special needs person of any age, as long as that person can establish that they were legally disabled prior to the age of 26.

Who is the remainder beneficiary of an ABLE account? The ABLE account is a “Medicaid Payback” account which means that, upon the death of the beneficiary, any remaining balance in this account must first be used to reimburse Medicaid for monies paid on behalf of the special needs person subsequent to the establishment of the ABLE account. When a beneficiary of an ABLE account is receiving Medicaid, it is important to consider how much should be placed in the ABLE account to limit what may be recovered by Medicaid at the end of the beneficiary’s life.

Who can create an ABLE account? An account may be established by anyone (the special needs person, a relative, or friend) for the benefit of an eligible beneficiary.

What are the ABLE Act’s financial limitations?

- Maximum Annual Contributions: Donors are limited to contributing up to the annual gift tax exclusion amount which is currently $14,000.

- Exemption Limitation: SSI only exempts the first $100,000 in the account.

- Maximum Account Balance: ABLE accounts may only accumulate aggregate contributions up to the state’s limit on qualified tuition programs (i.e. 529 accounts), which ranges between $300,000 and $400,000. Therefore, if an individual receives SSI, his or her ABLE account may not exceed $100,000 and s/he may have other assets up to only $2,000. Otherwise, the individual will become ineligible to continue receiving SSI, but can remain eligible for Medicaid.

What are the tax benefits of an ABLE account?

- Taxation of Qualified Distributions: Qualified distributions from the account are not counted as taxable to either the donor or the beneficiary. Qualified distributions include those paid on behalf of the beneficiary that are related to education, housing, transportation, employment training and support, assistive technology and personal support services, health and wellness, financial management and administrative services, legal fees, expenses for oversight and monitoring, post-mortem expenses, and/or any other expenses approved by the Secretary of Treasury.

- Taxation of Earnings: Contributions are made post income tax but the earnings on the ABLE account are not taxable to the contributor or to the beneficiary.

- Rollover of Account: Assets in an ABLE account may be rolled over to another ABLE account for the benefit of another qualified beneficiary who is also a sibling or step-sibling of the beneficiary.

While the ABLE Act provides an attractive option for those with special needs, there are some situations where it is an inadequate or inappropriate alternative to a special needs trust, such as where the qualified beneficiary is about to receive litigation or settlement proceeds or a large inheritance. Further, like every tool, the ABLE account has its benefits and limitations. Knowing when an ABLE account is appropriate and knowing when another option might be more suitable is a decision that should only be made after consulting with professionals proficient in special needs planning.

We Can Do Better, South Carolina!

We Can Do Better, South Carolina!