Commentary by Andy Brack | The crazy case of where GOP Senate District 41 candidate Sandy Senn actually lives has taken even more quirky turns.

Not only has a state judge issued an injunction postponing a hearing on a challenge to Senn’s residency, but a letter has turned up that seems to make it even more confusing about when she actually moved from a home outside the Senate district to a townhouse inside it.

Not only has a state judge issued an injunction postponing a hearing on a challenge to Senn’s residency, but a letter has turned up that seems to make it even more confusing about when she actually moved from a home outside the Senate district to a townhouse inside it.

It’s enough to make you do a triple take.

Last month, a column highlighted how the state has squishy campaign residency laws that allow candidates to cherry-pick districts to move into near elections to try to win seats in the legislature. One candidate cited was Senn, a Charleston attorney who told us she lived outside the district in Folly Beach until the fall of 2015 when she took a townhouse inside the district near her office in South Windermere.

The column emphasized how the law by default allows such moves because legislative candidates are required to live in the district in which they are running on the day they file for office and on election days. She filed in March to run for the Senate seat currently held by outgoing Sen. Paul Thurmond, R-Charleston.

But James Island lawyer Margaret Fabri last week challenged Senn’s residency in a document filed with the Charleston County Board of Elections and Voter Registration. The board was scheduled to take up the challenge at 9 a.m. today.

Late Wednesday, however, the S.C. Republican Party intervened with a motion to keep the hearing from proceeding. Why? Because it claimed the board didn’t have the authority to hold a hearing on a candidate’s residency. It said state party executive committees, not bipartisan boards, had the authority to hold protests [S.C. Code Sec. 7-17-560]. At 10:52 p.m. Wednesday, state Circuit Judge Diane S. Goodstein signed the order scheduling a hearing on arguments related to the temporary injunction. It is set for 2 p.m. June 20 before Judge Doyet A. Early III in the Charleston County Courthouse.

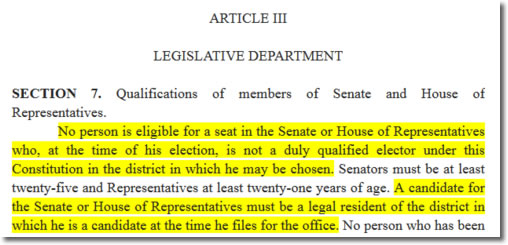

Maybe the state Constitution can give a little guidance. Article III, Section 7 says no one is eligible for a seat in the state House or Senate unless he or she is a “duly qualified elector” in the legislative district. In other words, candidates have to live in the districts on election days — and they also have to live on the date they file for office.

Maybe the state Constitution can give a little guidance. Article III, Section 7 says no one is eligible for a seat in the state House or Senate unless he or she is a “duly qualified elector” in the legislative district. In other words, candidates have to live in the districts on election days — and they also have to live on the date they file for office.

Who decides whether someone is a “duly qualified elector”? According to another law, it’s not a political party but an (wait for it) election board, as outlined in S.C. Code Sec. 7-5-230: “The county boards of voter registration and elections to be appointed under Section 7-5-10 shall be the judges of the legal qualifications of all applicants for registration. The board is empowered to require proof of these qualifications as it considers necessary.”

Fabri told us today, “My challenge had to do with the qualifications of Ms. Senn as an elector in District 41, not her candidacy.”

Senn

Senn told us last month that she lived on Folly Beach about four miles outside the district until the fall of 2015 when she moved into the townhouse. On Dec. 1, 2015, she filled out a form that showed she changed her voter registration to the townhouse. On March 16, 2016, she filled out a “Statement of Intention of Candidacy & Party Pledge” for the Republican Party when filing for office that included the townhouse address.

But where it all gets wonky came on June 3, the day Fabri filed her challenge. On that same day, Senn sent a letter to County Auditor Peter Tecklenburg, County Assessor Toy Glennon and County Treasurer Andrew Smith in which she talked a lot about a 4 percent county tax rate that owners of homes get if they occupy their homes and the 6 percent rate they get if they own it but it is not their primary residence.

Take away some of the math and note these opening passages:

“I formerly lived at 290 Little Oak Island Drive on Folly Beach and claimed the 4% residency rate. I signed a lease in November of 2015 on a town home at 498 Albemarle Road. I do not own that town home and therefore cannot claim the 4% rate. While I moved furniture into the town home after Thanksgiving, I did not move my clothing and other necessary belongings until January 2, 2016, which is when my family and I returned from an overseas Christmas Holiday.

“I received a tax notice for that property in October and paid that bill in January which was for 2015 taxes. In 2015 I indeed lived on Folly Beach.” [Emphasis added.] She notes later that she “clearly lived” in the district on the date of filing.

It’s enough to make your head spin. She signed a card that says she should vote in the district when she didn’t live in it. Then before the filing period, she actually moved into the district, but waited until the day somebody challenged her residency to write the tax folks about the change to her tax rate.

Whew! You make the call.

We Can Do Better, South Carolina!

We Can Do Better, South Carolina!